SSI-SCA (Vietnam Fund)

Fund Overview

About SSI-SCA

SSI-SCA (SSI Sustainable Competitive Advantage Fund) is an open-end mutual fund based in Vietnam. The fund invests in high-quality equities listed on Vietnam’s leading stock exchanges — the Ho Chi Minh Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX). Managed by an experienced team of Vietnamese investment professionals, SSI-SCA focuses on companies with strong, sustainable competitive advantages and long-term growth potential. The fund offers investors an opportunity to participate in the dynamic and rapidly growing Vietnamese equity market.

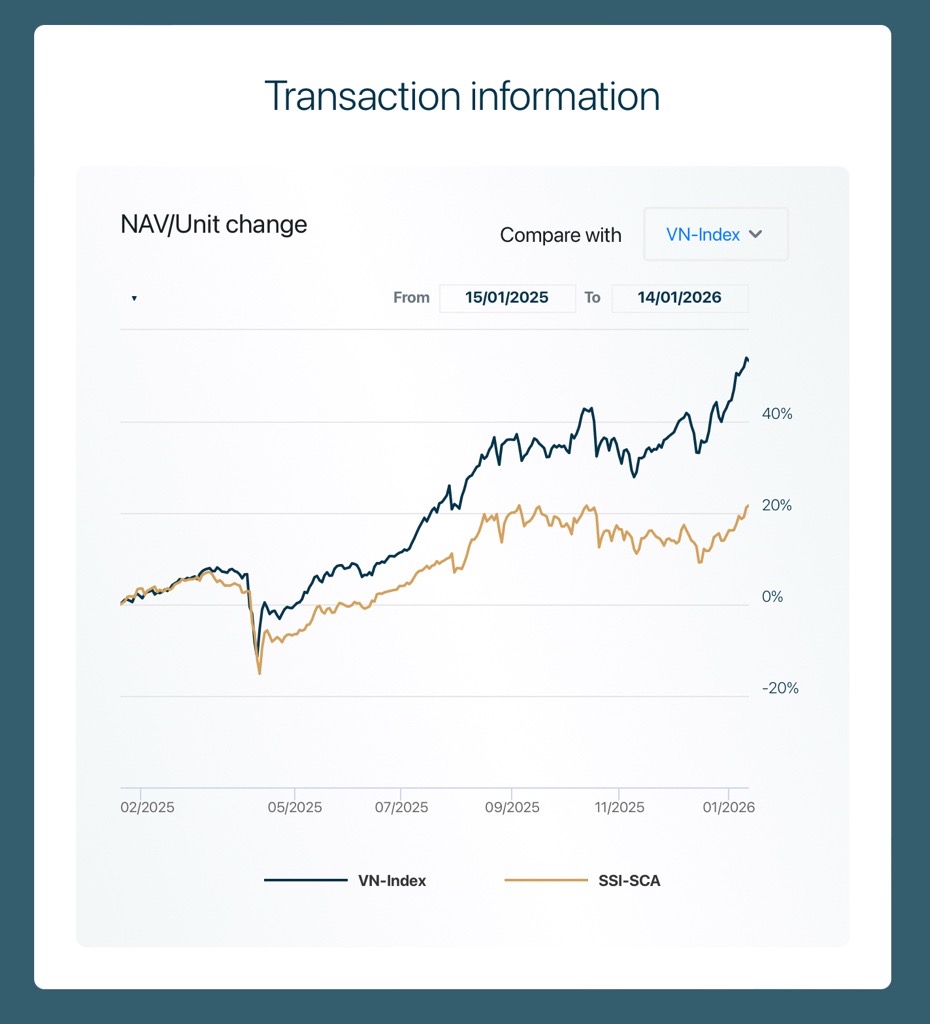

Total Return since the beginning of 2025

As of 31 May, 2025

SSI Asset Management Co., Ltd. (SSIAM) is a licensed asset management company headquartered in Vietnam. The company provides professional investment management services to international institutional investors, domestic institutions, and both domestic and international individual clients. As of December 31, 2022, SSIAM managed total assets under management (AUM) of USD 579 million. The firm’s investment team comprises more than 25 experienced portfolio managers and research analysts, possessing extensive expertise, in-depth knowledge of the Vietnamese capital markets, and a strong track record in managing investments across various asset classes.

As of December 31, 2022, SSIAM managed total assets under management (AUM) of USD 579 million. The firm’s investment team comprises more than 25 experienced portfolio managers and research analysts, possessing extensive expertise, in-depth knowledge of the Vietnamese capital markets, and a strong track record in managing investments across various asset classes.

Fund Management

The SSI Sustainable Competitive Advantage Fund (SSI-SCA) is managed by SSI Asset Management Co., Ltd. (SSIAM).

How does SSI-SCA differ from other Vietnamese Investment Funds?

Thai investors seeking exposure to the Vietnamese capital markets typically have the following options:

- Direct investment via Thai brokerage firms;

- Investment through Thai mutual funds or private funds that directly invest in Vietnamese equities;

- Investment through Thai Fund of Funds that allocate capital to foreign funds, such as ETFs, investing in Vietnamese equities;

- Investment in Depositary Receipts (DRs) representing ETFs tracking Vietnam’s VN30 Index;

- Investment through Vietnamese mutual funds managed locally by Vietnamese professionals, distributed via authorized representatives such as Trinity Securities Co., Ltd.

SSI-SCA distinguishes itself by being managed by experienced Vietnamese fund managers who possess comprehensive knowledge and deep insights into the local market. The investment team is fully immersed in the Vietnamese business environment, eliminating language and cultural barriers and providing access to timely and detailed market intelligence. This local expertise allows SSI-SCA to apply a disciplined value investment approach that maximizes long-term benefits for investors.

SSI-SCA Asset Allocation

SSI-SCA invests exclusively in equities listed on the Ho Chi Minh Stock Exchange and Hanoi Stock Exchange.

SSI-SCA Target Investor Profile

SSI-SCA is designed for Thai investors with a long-term investment horizon and the ability to accept market volatility. It is suitable for those seeking to diversify their portfolios internationally and who have capital available for investment over an extended period, awaiting market recognition of intrinsic stock values.

SSI-SCA Investment Strategy

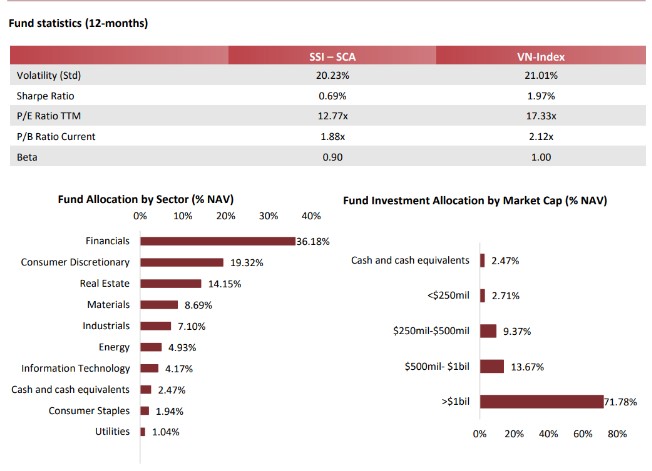

SSI-SCA employs an active investment strategy focusing on companies with sustainable competitive advantages. The fund targets market leaders with strong market positions, transparent and accountable corporate governance, solid financial health, and robust operational capabilities, even during adverse market conditions. The fund emphasizes investing in companies with attractive fundamental valuations relative to their future growth prospects.

SSI-SCA stock selection philosophy

SSI-SCA SSI-SCA utilizes an active, research-driven process to identify investment opportunities. The fund integrates macroeconomic analysis and proprietary investment models to construct a diversified portfolio aligned with current market conditions. Investment decisions prioritize industries with favorable valuations and growth potential, supported by rigorous risk management frameworks.

Companies with high market capitalization and liquidity;Companies with high market capitalization and liquidity; Market leadership with long-term competitive advantages; Quality and transparent management; Strong financial positions; Superior investment returns compared to industry peers; Attractive growth potential.The fund may also allocate a portion of assets to smaller-cap companies with growth potential at reasonable valuations.

- Stock selection process:

Step 1: Conduct top-down macroeconomic analysis to identify sectors and companies with growth potential.

Step 2: Screen for companies meeting strict quality and valuation benchmarks.

Step 3: Construct a diversified portfolio using an active management approach, balancing growth prospects and risk across various sectors.

SSI-SCA Investment policy

- Focus on companies exhibiting sustainable competitive advantages and low risk, capable of consistent long-term growth.

- Target sectors benefiting most from Vietnam’s economic expansion, with robust business models and exemplary corporate governance.

- Maintain a long-term investment horizon, selecting undervalued companies relative to their intrinsic growth potential.

- Concentrate investments in sectors poised for sustained growth aligned with Vietnam’s economic development, including financial services, consumer retail, tourism, construction, banking, jewelry, technology, energy and petroleum, services, and pharmaceuticals.

Asset Allocation of SSI-SCA Fund

Risks Associated with Investing in the SSI-SCA Fund

- Investing in SSI-SCA carries similar risks to other types of investments. The primary consideration for investors is to assess their own risk tolerance before investing. The Fund Manager actively manages these risks through established risk management processes.

- Inflation Risk

- Interest rate risk

- Exchange rate risk

- Price Volatility risk

- Legal Risk

- Risk of investment Strategies

- Risk of investment restriction

- Risk of Valuation

- Settlement Risk

- Hedging Instruments

- Liquidity Risk

- Risk of Fund Management Operation

- Conflict of interest Risk

- Force Majeure Risk

Investment Restrictions of the SSI-SCA Fund SSI-SCA

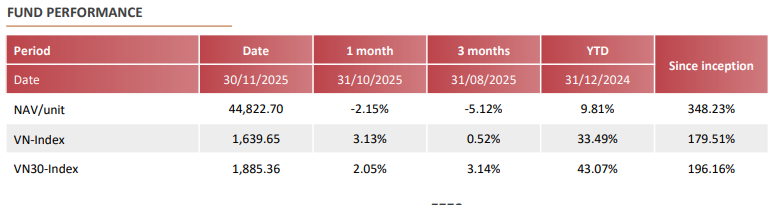

Fund Benchmark

The Fund’s performance benchmark is the VN-Index (VNI), a capitalization-weighted index representing all listed companies on the Ho Chi Minh City Stock Exchange. The VN-Index was established with a base value of 100 on July 28, 2000.

Latest NAV Information SSI-SCA

Investors will receive monthly NAV statements from Trinity Securities Co., Ltd., the appointed distributor.

Recommended Investment Horizon

A minimum investment horizon of two (2) years is recommended to allow sufficient time for the Fund’s investments to perform and for investors to benefit from potential capital appreciation. Additionally, investors holding the fund for at least two years will not be subject to redemption fees.

Transferring Fund Units to Third Parties

Unit transfers are permitted but not recommended due to complex processes, time, and associated costs. Transfers must be made as gifts, inheritances, or donations, and require notarization at the Embassy of Vietnam in Thailand. The recipient is responsible for paying applicable gift or inheritance taxes of 10% of the NAV. Trinity Securities recommends that investors sell and repurchase units rather than transferring them.

Tax Considerations

For Thai investors (non-residents), transferring fund units as gifts or inheritance is subject to a 10% tax on the portion of the value exceeding 10 million VND.

A 0.10% tax will be applied to redemption proceeds. This tax is withheld at source.

If investors repatriate income (including capital gains, dividends, interest, and other benefits) from the sale of fund units or other foreign securities back to Thailand within the same fiscal year, such income is subject to personal income tax in Thailand.